Do You Pay Sales Tax On A Boat In Missouri . Every state has a different. motor vehicle, trailer, atv and watercraft tax calculator. The department collects taxes when an applicant applies for title. Varies from county to county—refer to the dor's online tax. While most services are exempt from tax, there. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; — how does sales tax work on boats? in the state of missouri, services are not generally considered to be taxable. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. Just like all goods, boats incur sales tax at closing. calculate sales tax on a boat by state. 4.225% of the purchase price.

from opendocs.com

Every state has a different. The department collects taxes when an applicant applies for title. — how does sales tax work on boats? — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; While most services are exempt from tax, there. motor vehicle, trailer, atv and watercraft tax calculator. calculate sales tax on a boat by state. in the state of missouri, services are not generally considered to be taxable. Varies from county to county—refer to the dor's online tax. Just like all goods, boats incur sales tax at closing.

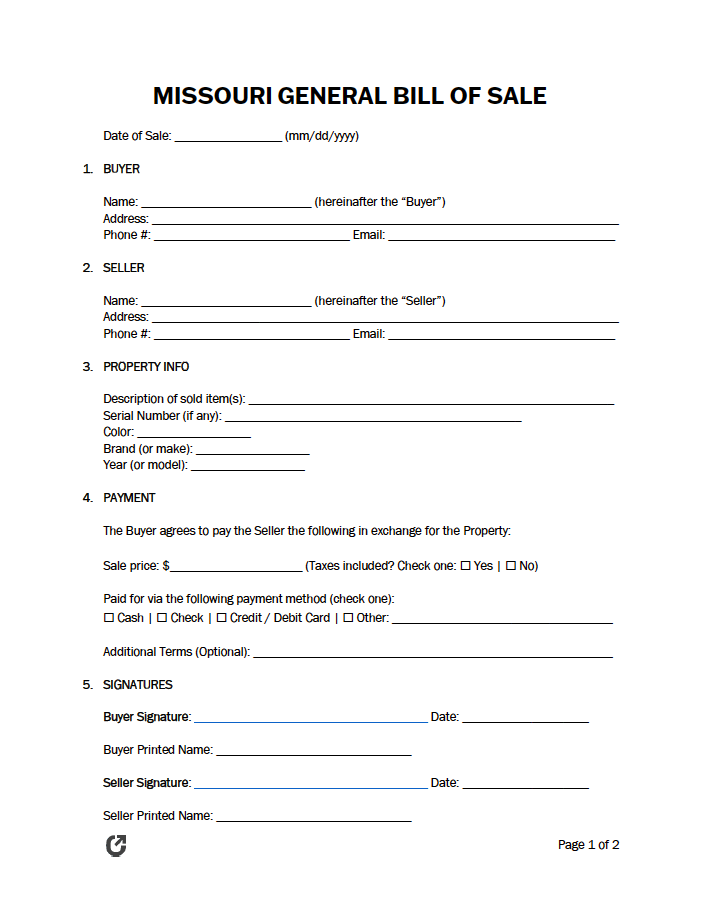

Free Missouri General Bill of Sale Form PDF WORD RTF

Do You Pay Sales Tax On A Boat In Missouri Varies from county to county—refer to the dor's online tax. — how does sales tax work on boats? Every state has a different. The department collects taxes when an applicant applies for title. While most services are exempt from tax, there. 4.225% of the purchase price. motor vehicle, trailer, atv and watercraft tax calculator. Just like all goods, boats incur sales tax at closing. Varies from county to county—refer to the dor's online tax. in the state of missouri, services are not generally considered to be taxable. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; calculate sales tax on a boat by state. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel.

From www.youtube.com

How To Calculate Sales Tax Using Math YouTube Do You Pay Sales Tax On A Boat In Missouri The department collects taxes when an applicant applies for title. While most services are exempt from tax, there. motor vehicle, trailer, atv and watercraft tax calculator. Every state has a different. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. — biggs must pay sales tax to. Do You Pay Sales Tax On A Boat In Missouri.

From studylib.net

Sales and Use Tax on Boats Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. Just like all goods, boats incur sales tax at closing. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; Every state has a different. Varies from county to county—refer to the dor's online tax. — how does sales tax work. Do You Pay Sales Tax On A Boat In Missouri.

From studylib.net

Sales and Use Tax on Boats Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. calculate sales tax on a boat by state. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; 4.225% of the purchase price. The department collects taxes when an applicant applies for title. Every state has a different. in the. Do You Pay Sales Tax On A Boat In Missouri.

From www.youtube.com

Do You Pay Sales Tax on Extended Warranty? YouTube Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. calculate sales tax on a boat by state. in the state of missouri, services are not generally considered to be taxable. 4.225% of the purchase price. — how does sales tax work on boats? The department collects taxes when an applicant applies for title. Just like all goods, boats. Do You Pay Sales Tax On A Boat In Missouri.

From printable.esad.edu.br

Bill Of Sale Missouri Free Printable Printable Templates Do You Pay Sales Tax On A Boat In Missouri Every state has a different. The department collects taxes when an applicant applies for title. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; calculate sales tax on a boat by state. Just like all goods, boats incur sales tax at closing. Varies from county to county—refer to. Do You Pay Sales Tax On A Boat In Missouri.

From maineboats.netlify.app

What is the sales tax on a boat in california Do You Pay Sales Tax On A Boat In Missouri 4.225% of the purchase price. Every state has a different. Just like all goods, boats incur sales tax at closing. calculate sales tax on a boat by state. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. in the state of missouri, services are not generally considered. Do You Pay Sales Tax On A Boat In Missouri.

From freeforms.com

Free Missouri (DMV) Bill of Sale Form for Motor Vehicle, Trailer, or Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. motor vehicle, trailer, atv and watercraft tax calculator. Varies from county to county—refer to the dor's online tax. 4.225% of the purchase price. Every state has a different. Just like all goods, boats incur sales tax at closing. — biggs must pay sales tax to the seller of the canoes. Do You Pay Sales Tax On A Boat In Missouri.

From maineboats.netlify.app

What is the sales tax on a boat in california Do You Pay Sales Tax On A Boat In Missouri Varies from county to county—refer to the dor's online tax. calculate sales tax on a boat by state. Just like all goods, boats incur sales tax at closing. — how does sales tax work on boats? The department collects taxes when an applicant applies for title. 4.225% of the purchase price. a licensed missouri boat dealer is. Do You Pay Sales Tax On A Boat In Missouri.

From clovisqstacie.pages.dev

Independence Mo Sales Tax Rate 2024 Allyn Giacinta Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. Just like all goods, boats incur sales tax at closing. motor vehicle, trailer, atv and watercraft tax calculator. 4.225% of the purchase price. Every state has a different. Varies from county to county—refer to the dor's online tax. in the state of missouri, services are not generally considered to be. Do You Pay Sales Tax On A Boat In Missouri.

From linkmybooks.com

How to Calculate Sales Tax A StepbyStep Guide Do You Pay Sales Tax On A Boat In Missouri The department collects taxes when an applicant applies for title. Varies from county to county—refer to the dor's online tax. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. 4.225% of the purchase price. — how does sales tax work on boats? — biggs must pay sales. Do You Pay Sales Tax On A Boat In Missouri.

From gioephlqr.blob.core.windows.net

Do You Pay Sales Tax On A Utv In Missouri at Vivian Stephenson blog Do You Pay Sales Tax On A Boat In Missouri a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. 4.225% of the purchase price. motor vehicle, trailer, atv and watercraft tax calculator. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; calculate sales tax on a. Do You Pay Sales Tax On A Boat In Missouri.

From www.patriotsoftware.com

Sales Tax Laws by State Ultimate Guide for Business Owners Do You Pay Sales Tax On A Boat In Missouri Varies from county to county—refer to the dor's online tax. While most services are exempt from tax, there. in the state of missouri, services are not generally considered to be taxable. — how does sales tax work on boats? — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of. Do You Pay Sales Tax On A Boat In Missouri.

From sportfishhub.com

How To Avoid Sales Taxes On A Boat Do You Pay Sales Tax On A Boat In Missouri — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; The department collects taxes when an applicant applies for title. Every state has a different. motor vehicle, trailer, atv and watercraft tax calculator. Just like all goods, boats incur sales tax at closing. in the state of missouri,. Do You Pay Sales Tax On A Boat In Missouri.

From boatpursuits.com

Do Houseboats Pay Property Tax? (Here’s What You Need To Know) Boat Do You Pay Sales Tax On A Boat In Missouri While most services are exempt from tax, there. Every state has a different. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; 4.225% of the purchase price. in the state of missouri, services are not generally considered to be taxable. Varies from county to county—refer to the dor's. Do You Pay Sales Tax On A Boat In Missouri.

From opendocs.com

Free Missouri General Bill of Sale Form PDF WORD RTF Do You Pay Sales Tax On A Boat In Missouri calculate sales tax on a boat by state. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; 4.225% of the purchase price. While most services are exempt from tax, there. The department collects taxes when an applicant applies for title. Every state has a different. Just like all. Do You Pay Sales Tax On A Boat In Missouri.

From www.printablelegaldoc.com

Free Printable Boat Bill Of Sale Form (GENERIC) Do You Pay Sales Tax On A Boat In Missouri Every state has a different. calculate sales tax on a boat by state. — how does sales tax work on boats? While most services are exempt from tax, there. Varies from county to county—refer to the dor's online tax. in the state of missouri, services are not generally considered to be taxable. The department collects taxes when. Do You Pay Sales Tax On A Boat In Missouri.

From sellercloud.com

What Is Sales Tax, and How Do I Calculate It? Sellercloud Do You Pay Sales Tax On A Boat In Missouri calculate sales tax on a boat by state. — biggs must pay sales tax to the seller of the canoes and paddleboats at the time of purchase; While most services are exempt from tax, there. motor vehicle, trailer, atv and watercraft tax calculator. Just like all goods, boats incur sales tax at closing. Varies from county to. Do You Pay Sales Tax On A Boat In Missouri.

From sportfishhub.com

How To Avoid Sales Taxes On A Boat Do You Pay Sales Tax On A Boat In Missouri Just like all goods, boats incur sales tax at closing. a licensed missouri boat dealer is not responsible for the collection of taxes on the sale of a vessel. 4.225% of the purchase price. — how does sales tax work on boats? — biggs must pay sales tax to the seller of the canoes and paddleboats at. Do You Pay Sales Tax On A Boat In Missouri.